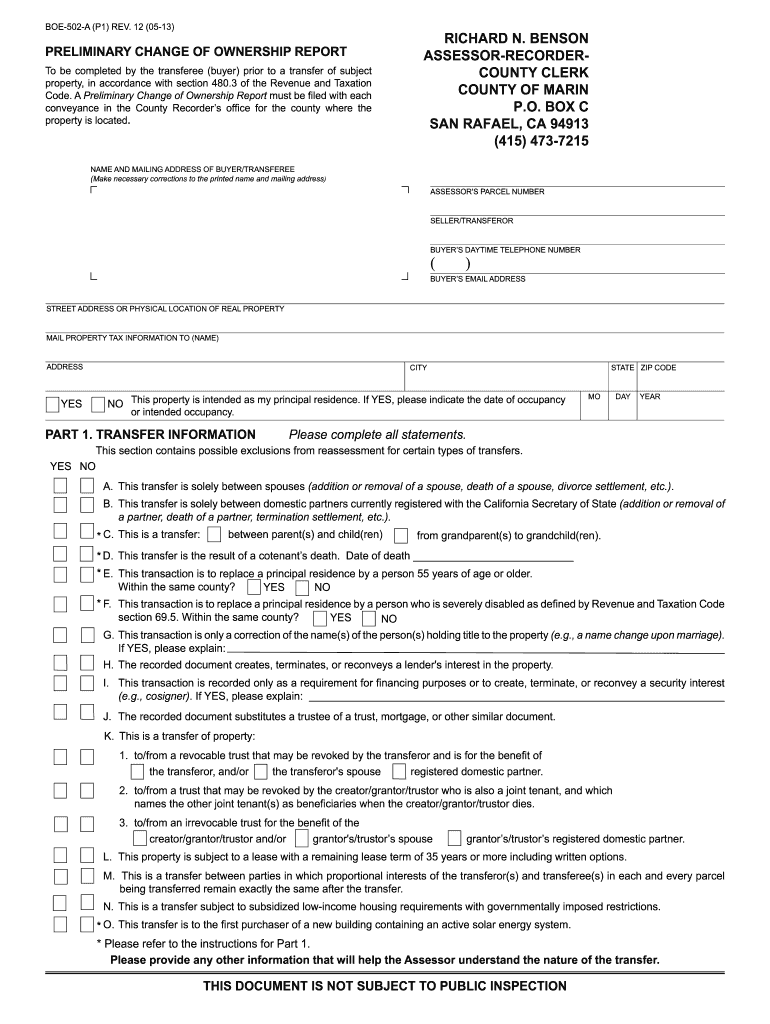

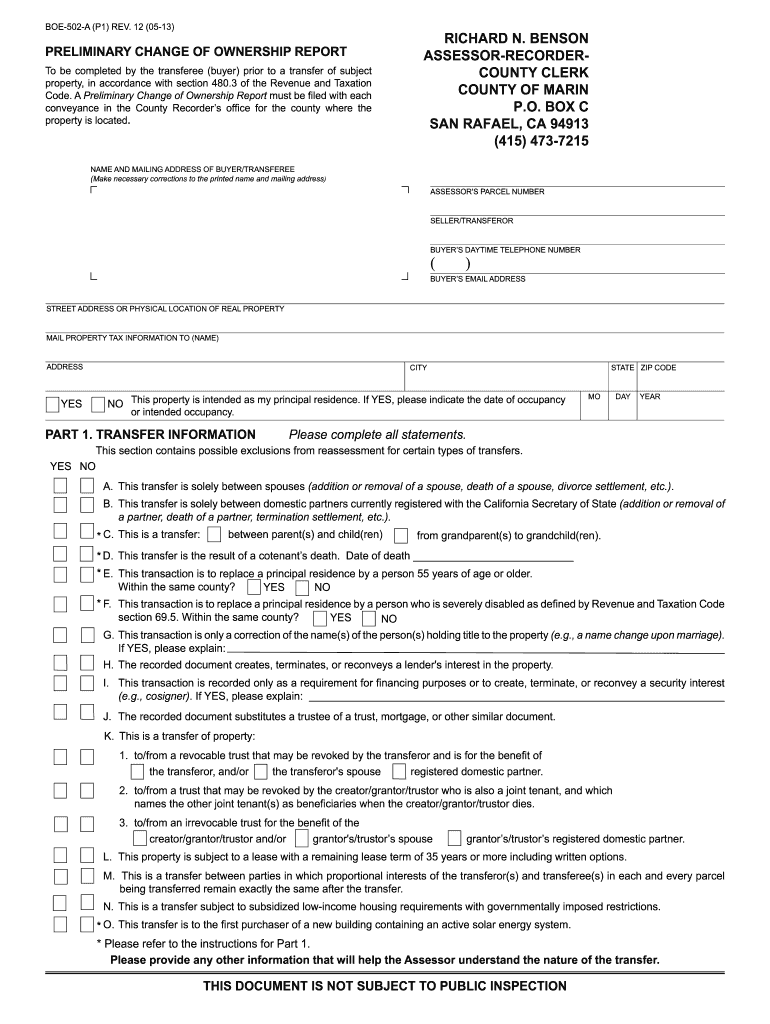

BOA_502-A (P1) 2013-2024 free printable template

Get, Create, Make and Sign

How to edit change ownership preliminary online

How to fill out change ownership preliminary form

How to fill out form property transfer:

Who needs form property transfer:

Video instructions and help with filling out and completing change ownership preliminary

Instructions and Help about form ownership report

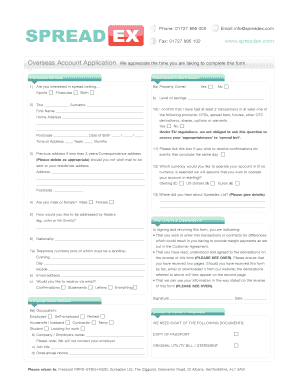

Music this is Gain duck Montoya with Albertson and Davidson we are going to be going through a form called the preliminary change of ownership report today the reason that you would fill out this form is for two reasons the first reason would be is that the County Recorder will not let you file your deed without it and the second reason is to save you a bunch of money on taxes the purpose of this form is to notify the county assessor that there has been a change in ownership of our real property it's also to notify the county assessor that you may qualify for tax exclusion, so we'll start at the beginning up in the left-hand corner you would type in your name if you're the one that's going to be receiving this property and this is your information, so we have decided to name the beneficiary in this instance Jane Smith we typed in her address then to the right which are going to be doing is you're going to be typing the property's APN number that is located on the deed so take a look at your deed and type the APN or the Assessors parcel number exactly as you see it next for our purposes generally in our field we deal with beneficiaries receiving real property through either a will or a trust or even an estate will say that John Smith is the trustee of that trust the reason we're not putting her parents name in here is because they are now deceased and the one who holds title to this property at this time is the trustee John Smith, so this is his name under that the buyers daytime telephone number even that this isn't a purchase this phone number would be your phone number if you're going to be the recipient of this property below that again under buyers email address that will be your address if you are the one receiving this property on the left-hand side you're going to want to put the street address or physical location of the real property that's being transferred so in this case we have typed an address in then you're going to want to go through each of these boxes below and make sure that it's properly filled out based on your information for our purposes generally the answer to these two boxes are now if you're is the top box is yes if you're intending this to be your principal residence you'd put yes, and then you would go ahead and fill in the dates that you intend to occupy the property below that is the where you want the property tax information mailed again if you're receiving this property you would want to put your information in here so again the beneficiary's name the beneficiary's address below that actually filled it out a little wrong I'm going to go ahead and move these items City over here okay now we get to the property transfer information you're going to want to go through this information carefully and check all that apply if is any of these boxes apply to you, you check yes if they do not apply you must check now, and we'll just go through a couple of the ones that we generally use for our purposes so if you take a look...

Fill change preliminary : Try Risk Free

People Also Ask about change ownership preliminary

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your change ownership preliminary form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.